Welcome to Radhika’s Newsletter “Intent”. This is your 3x/month guide to purposeful living, wealth-building, and personal growth.

Happy Tuesday! I’m so excited to share this edition of Intent. Today’s topic is all about Alternative Assets. We’re diving deep into why this matters and how it can transform the way you approach investing.

I’m about to unpack a world you’ve probably never heard about. A world beyond your regular investing and a step beyond the stock market. It’s a space where you can tap into your unique strengths, diversify your portfolio, and build wealth in ways you probably never thought possible.

Disclaimer: Please note that all investments carry risks, including the potential loss of principal. This content is intended for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

As always, I’ve got some exciting insights to share with you! So let’s jump right in and explore how you can start making these strategies work for you!

What I’m Sipping On This Month

This month, I’m sipping on Ginger Lemon Tea, which has been the perfect blend for helping me feel better and get back on track after being under the weather. Whether you're recovering or just in need of something comforting, this tea has been my go-to. Have you tried it? Let me know your favorite teas - I’d love to hear it!

Why Invest in Alternative Assets?

Here’s the thing: Traditional investments like stocks and bonds have their place, but they’re no longer the only players in the game. Alternative assets are taking the spotlight, and for good reason.

These investments go beyond the usual suspects, offering a chance to diversify, boost your portfolio, and tap into markets that aren’t always tied to the stock market’s ups and downs. The best part? Many alternative assets have the potential for higher returns, and they give you access to new opportunities that are as exciting as they are profitable.

Ready to explore? Let’s break down the different types of alternative assets you can invest in right now.

Alternative Assets Resources

Here are some alternative investments that could supercharge your portfolio:

YieldStreet

What It Is: YieldStreet is an online tool that offers access to a variety of non-traditional investment opportunities, from real estate to art and even legal finance.

How It Helps: This platform is a game-changer for diversifying your investments. With YieldStreet, you can tap into private markets that were once only available to high-net-worth individuals. There’s even filters to help you select the minimum investment amount. Remember you want to be fully comfortable letting go of that money, especially if it’s your first time investing in a new asset class.

Real Estate Syndication

What It is: Essentially a syndication is a way to invest in real estate without putting all of your money down or being the only responsible person for a property. Real Estate Syndication allows you to pool funds with other investors to invest in large-scale commercial properties.

How It Helps: This is a great way to get into real estate without needing millions upfront. Plus, you’ll be sharing in the rental income and property appreciation. Often times, you’re a small investor in the bigger deal and you get rental income along the way and still claim depreciation on your tax returns.Whiskey, Wine & Alcohol (Vinovest)

What It Is: Vionvest lets you invest in high-quality whiskey, wine, and other alcohol assets that are appreciating in value. Investing in alcohol is something I thought only highly knowledgable and the ultra-wealthy could do. While some of that is partially true, Vinovest allows you to start with $1000.

Fun Fact: Did you know that the world’s oldest whiskey is over 150 years old? It’s a bottle of Old Vatted Glenlivet 1862, and it sold for over $40,000 at auction! The bottle was discovered in a dusty attic in Scotland and is considered one of the most valuable and rare whiskies in the world. Crazy!Gold

What It Does: Gold is a tried-and-true asset that’s historically been a hedge against inflation and economic uncertainty. If you ask my mom, this is the best investment you can make. She always refers to how in the last 25 years, Gold has been the biggest asset for her and appreciated over 560%.

How It Helps: Adding gold to your portfolio provides a layer of protection against market volatility while maintaining a solid store of value. Plus, if you’re the kind of person that likes physical assets, it’s a great way to break into that word without spending tens of thousands of dollars.Tech Startups

What It Means & How It Works: Investing in tech startups allows you to back the next big thing in industries like AI, health tech, or fintech. Yes yes I know what you’re thinking: how can I (a regular person) invest in a tech startup. There’s a term called: Angel Investors referring to individuals investing in Seed or small stage startups. To qualify as an accredited angel investor, you need to be able to meet at least one of these criteria’s:At least $1mil in Net Worth

Earning $200k for more than 2 consecutive years individually or $300k for more than 2 consultive years jointly with a partner.

Passing one of following the financial exam: Series 7, Series 65, or Series 82

Caveat: While Tech startups can have an IMMENSE upside, this is also the riskiest investment because a lot of them fail. In fact, only less than 10% of startups actually make it. My best advice here is to connect with other Angel investors, join groups, and doing deep research into the sector you’re interested in investing.

Acquire.com // Startups

What It Does: Acquire.com connects buyers and sellers of startups, making it easier for you to invest in emerging businesses. Here you can buy and sell SaaS, ecommerce, agencies, content, newsletters, mobile apps and crypto businesses. Often times, these are passion projects of developers looking to sell something off. Sometimes, they are profitable businesses making it a great investment!

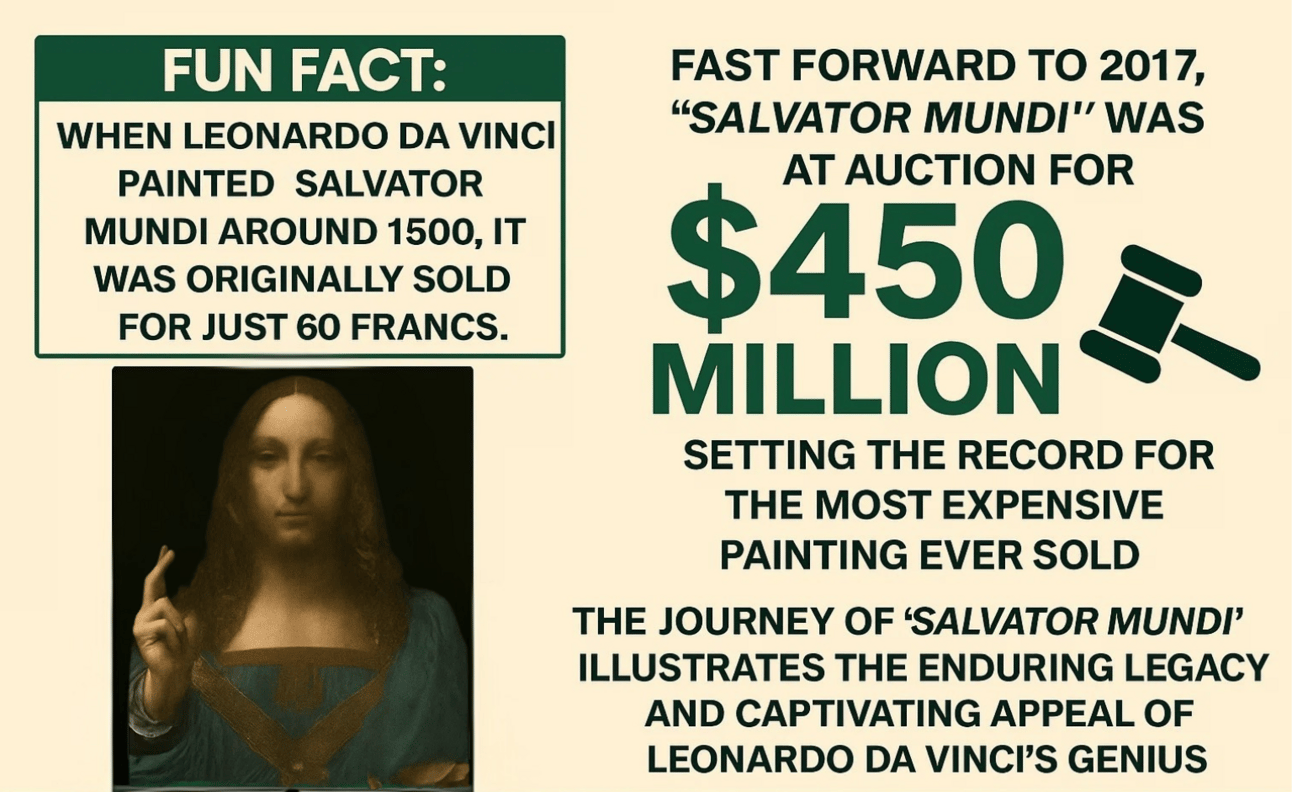

Note: This is a great opportunity for people looking to jump into a business without having to come up with the idea themselves and already starting with a platform. It’s also a great time to think about flipping a business. Meaning: take something that’s either breaking even or producing minimal cash flow & turn it around through marketing and adding a few more features to help grow it. Just some food for thought.Artwork (Masterworks, Saatchi Art, etc.)

What It Is: Investing in art allows you to own shares in high-value, appreciating works from renowned artists. Fine art has consistently shown strong returns, often outperforming traditional asset classes over the long term. By investing in art, you’re tapping into a market that can offer both financial and emotional returns, providing access to masterpieces that can appreciate in value over time.Things to Consider: Art is a tangible asset that has been considered a reliable store of wealth. It offers a unique opportunity for diversification, providing an alternative to traditional investments like stocks and bonds. As an investor, you gain fractional ownership, allowing you to share in the appreciation of an artwork without purchasing the entire piece. Keep in mind this is another asset class where highly technical knowledge is helpful so remember to do your research.

BuyBizSell // Buying Businesses

What It Does: BuyBizSell helps you connect with small businesses for sale, opening up the chance to become an owner and operator. These businesses are what you would call ‘boring business’ such as a laundromat, a vending machine, and so forth.

Why It Might Be For You: Instead of starting from scratch, buy an established business and begin profiting right away. Also, you can get started with as little as $0 down through SMB loans and find businesses that already cashflow. These are great because you know people will always need vending machines & laundromats so they’re a bit more reliable to invest in.Collectibles (Shoes, Comic Books, Purses, etc.)

What It Does: Collectibles like rare sneakers, comic books, vintage purses, and trading cards have evolved into valuable investments. Items such as first-edition Pokémon cards and exclusive sneakers are seeing significant appreciation, driven by pop culture, rarity, and exclusivity.How It Helps: Investing in collectibles allows you to diversify your portfolio with tangible assets that often appreciate over time. The value of these items is driven by factors like rarity, condition, and cultural significance. Again: highly specific knowledge is helpful in collectibles.

Fun Fact: Did you know that a mint condition copy of Action Comics #1, which features the first appearance of Superman, sold for a record-breaking $3.25 million in 2021? This iconic comic book is considered the holy grail of comic collectors, highlighting just how valuable these collectibles can become over time.Cryptocurrency (Coinbase)

What It Does: Cryptocurrencies like Bitcoin, Ethereum, and others operate on decentralized platforms and have exploded in popularity in recent years.

How It Helps: With platforms like Coinbase, you can trade and invest in a wide variety of cryptocurrencies. It’s a volatile but exciting space, perfect for those who love risk and innovation.

Fun Fact: Did you know that Bitcoin was used to buy two pizzas in 2010 for 10,000 BTC? At that time, 10,000 Bitcoin was worth around $41. Fast forward to 2025, and those same 10,000 Bitcoins would be worth over $250 million! It’s widely considered the most expensive pizza in history, highlighting just how much cryptocurrency has appreciated over the years.

Risks to Keep in Mind

While alternative assets can offer exciting growth opportunities, they also come with their own set of risks:

Liquidity: Many alternative assets are less liquid than traditional stocks or bonds. It can be harder to sell quickly if you need to access your money.

Valuation: Unlike stocks, which have well-established markets, alternative assets may be harder to value, especially for unique items like art or collectibles.

Market Risk: Some alternative assets, like cryptocurrency or tech startups, can be extremely volatile, with prices that fluctuate dramatically.

Regulatory Risk: The rules and regulations surrounding alternative investments can change, especially in emerging markets like cryptocurrency or private equity.

Accredited Investor and What it Means

Many alternative assets are only accessible to accredited investors or those who meet specific financial criteria, such as having a certain net worth or annual income. If you're not an accredited investor, don’t worry! There are still plenty of opportunities available, but you may need to get creative with your investment strategies.

Understanding what qualifies someone as an accredited investor can open up access to a wider range of alternative investments. This typically includes income thresholds (e.g., $200,000/year) or a certain net worth (e.g., $1 million excluding your primary residence).

Why Alternative Assets Are Worth Considering

Alternative assets offer a diverse range of opportunities for investors looking to expand their portfolios. While there are risks involved, the potential for high returns, diversification, and the opportunity to invest in unique markets can make alternative assets a valuable part of your financial strategy.

With the right approach and research, diving into these alternative opportunities can unlock growth and take your investment strategy to new heights. It’s all about finding the right fit for your financial goals and embracing the potential these assets offer.

Support My Work

Enjoying this newsletter? If you’d like to support my work, you can buy me tea. Your support means so much! Every cup helps fuel the ideas, research, and energy I put into each newsletter.

Thank you so much for being a part of the Intent community. I rely on word-of-mouth for growth. If you enjoyed this newsletter, I’d love for you to share it with a friend.

Your commitment to living with purpose is exactly why this space exists. Can’t wait to share more in the next edition!

Until next time,

Radhika

Creating a life of purpose, wealth, and growth.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI